Use the Table Below to Calculate the Accounting and Economic Profit for Abner s Apple Art

What are Variable Costs?

Variable costs are expenses that vary in proportion to the volume of goods or services that a business concern produces. In other words, they are costs that vary depending on the volume of activity. The costs increase as the volume of activities increases and decrease as the volume of activities decreases.

The Most Common Variable Costs

- Straight materials

- Direct labor

- Transaction fees

- Commissions

- Utility costs

- Billable labor

Essentially, if a cost varies depending on the volume of action, information technology is a variable cost.

Formula for Variable Costs

Total Variable Cost = Full Quantity of Output 10 Variable Cost Per Unit of Output

Variable vs Stock-still Costs in Determination-Making

Costs incurred by businesses consist of stock-still and variable costs. As mentioned above, variable expenses do not remain constant when production levels change. On the other hand, fixed costs are costs that remain constant regardless of product levels (such as office rent). Agreement which costs are variable and which costs are fixed are important to business decision-making.

For example, Amy is quite concerned well-nigh her bakery as the revenue generated from sales are beneath the total costs of running the bakery. Amy asks for your stance on whether she should shut downwards the concern or not. Additionally, she's already committed to paying for one year of rent, electricity, and employee salaries.

Therefore, fifty-fifty if the business were to shut downwardly, Amy would still incur these costs until the year-end. In January, the business reported revenues of $3,000 but incurred total costs of $4,000, for a net loss of $1,000. Amy estimates that Feb should experience revenues similar to that of Jan. Amy'due south list of costs for the bakery is as follows:

A. Jan fixed costs:

- Rent: $1,000

- Electricity: $200

- Employee salaries: $500

Total January fixed costs: $1,700

B. Jan variable expenses:

- Toll of flour, butter, saccharide, and milk: $1,800

- Full price of labor: $500

Total January variable costs: $ii,300

If Amy did not know which costs were variable or fixed, it would be harder to make an appropriate decision. In this case, we can see that total fixed costs are $ane,700 and total variable expenses are $2,300.

If Amy were to close down the business, Amy must still pay monthly fixed costs of $1,700. If Amy were to continue operating despite losing money, she would simply lose $1,000 per calendar month ($3,000 in revenue – $4,000 in total costs). Therefore, Amy would actually lose more than money ($one,700 per month) if she were to discontinue the business altogether.

This example illustrates the function that costs play in decision-making. In this case, the optimal decision would exist for Amy to keep in business while looking for means to reduce the variable expenses incurred from production (e.g., see if she can secure raw materials at a lower price).

Instance of Variable Costs

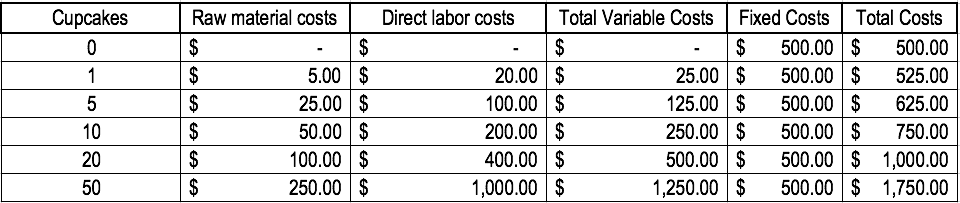

Let usa consider a baker that produces cakes. It costs $5 in raw materials and $twenty in direct labor to bake ane cake. In add-on, there are fixed costs of $500 (the equipment used). To illustrate the concept, see the table below:

Annotation how the costs change equally more cakes are produced.

Break-even Assay

Variable costs play an integral role in suspension-even analysis. Break-even analysis is used to decide the amount of revenue or the required units to sell to encompass total costs. The break-fifty-fifty formula is given as follows:

Break-even Point in Units = Stock-still Costs / (Sales Price per Unit – Variable Cost per Unit)

Consider the following instance:

Amy wants you to determine the minimum units of goods that she needs to sell in guild to achieve break-even each month. The bakery but sells one item: cakes. The stock-still costs of running the baker are $1,700 a month and the variable costs of producing a cake are $5 in raw materials and $xx of direct labor. Additionally, Amy sells the cakes at a sales price of $30.

To determine the suspension-even point in units:

Intermission-fifty-fifty Bespeak in Units = $ane,700 / ($thirty – $25) = 340 units

Therefore, for Amy to break even, she would need to sell at least 340 cakes a calendar month.

Video Explanation of Costs

Watch this short video to speedily empathize the chief concepts covered in this guide, including what variable costs are, the common types of variable costs, the formula, and interruption-even assay.

Related Readings

Thank you for reading CFI's guide to Variable Costs. To proceed advancing your career, the boosted resources below will be useful:

- Cost Structure

- Projecting Balance Sail Items

- Analysis of Financial Statements

- Cost Beliefs Analysis

farquharyesectood.blogspot.com

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/variable-costs/

Post a Comment for "Use the Table Below to Calculate the Accounting and Economic Profit for Abner s Apple Art"